|

Assignment Twelve

|

|

In this assignment, we will look at:

|

|

More on Worksheets and Adjusting Entries --

|

We are going to add a few items to our accounting process to make our adjustment

process more complete. If you do not already have these items it is time to add them.

-

Inventory Tracking - For this assignment you can make up your number for

inventory on hand. It must be different from your purchase. You must have

used some of your inventory in the course of doing business.

-

Unearned Revenue - Here you will receive payment for something before you perform

the service or sell the goods. For example: sale of a river rafting package, sale

of a service that provides 3 custom presentations over the next year for a reduced

rate, tickets to a livestock auction, tickets to an art exhibition.

-

Supplies Inventory - Recognize the loss of supplies in the course of doing business

and account for this change in the adjusting process.

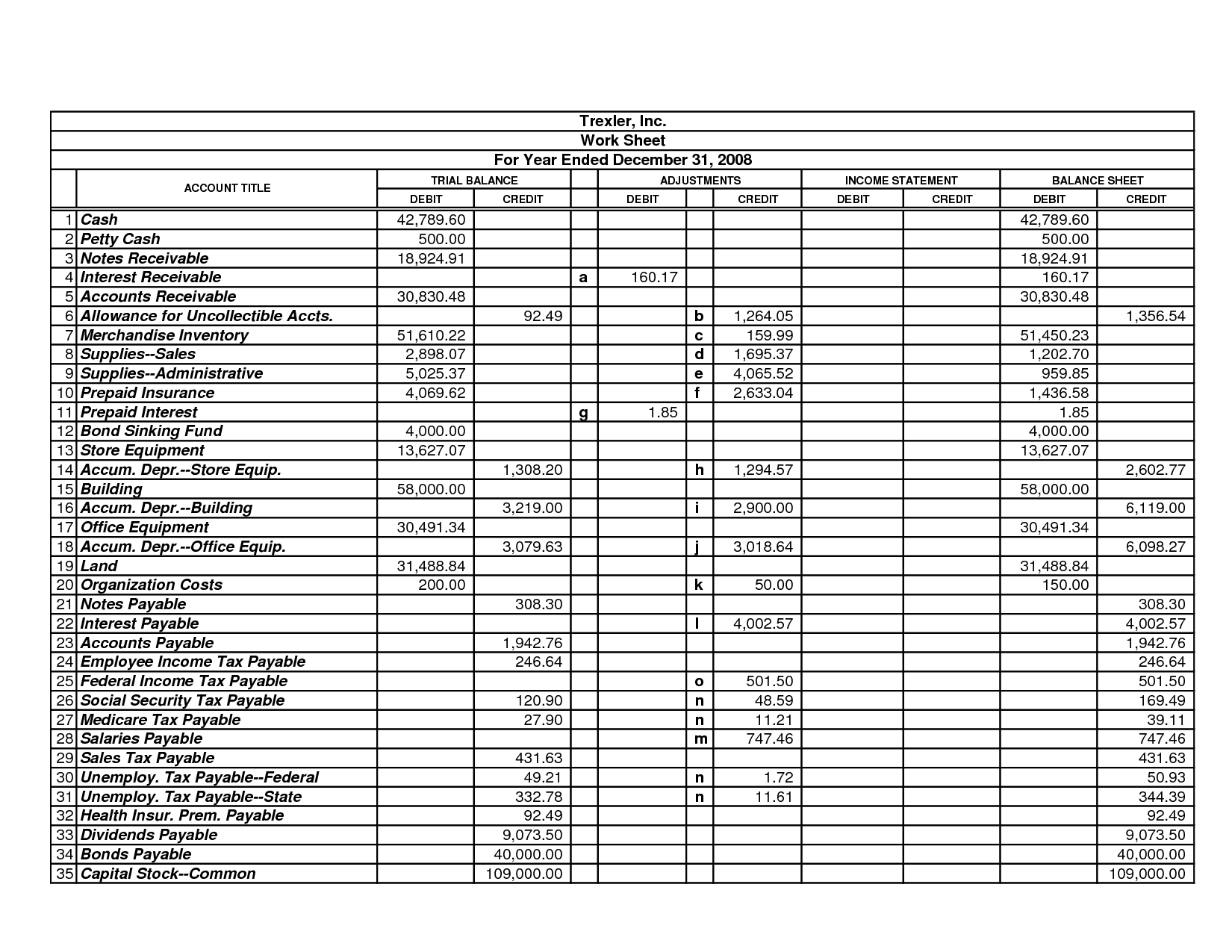

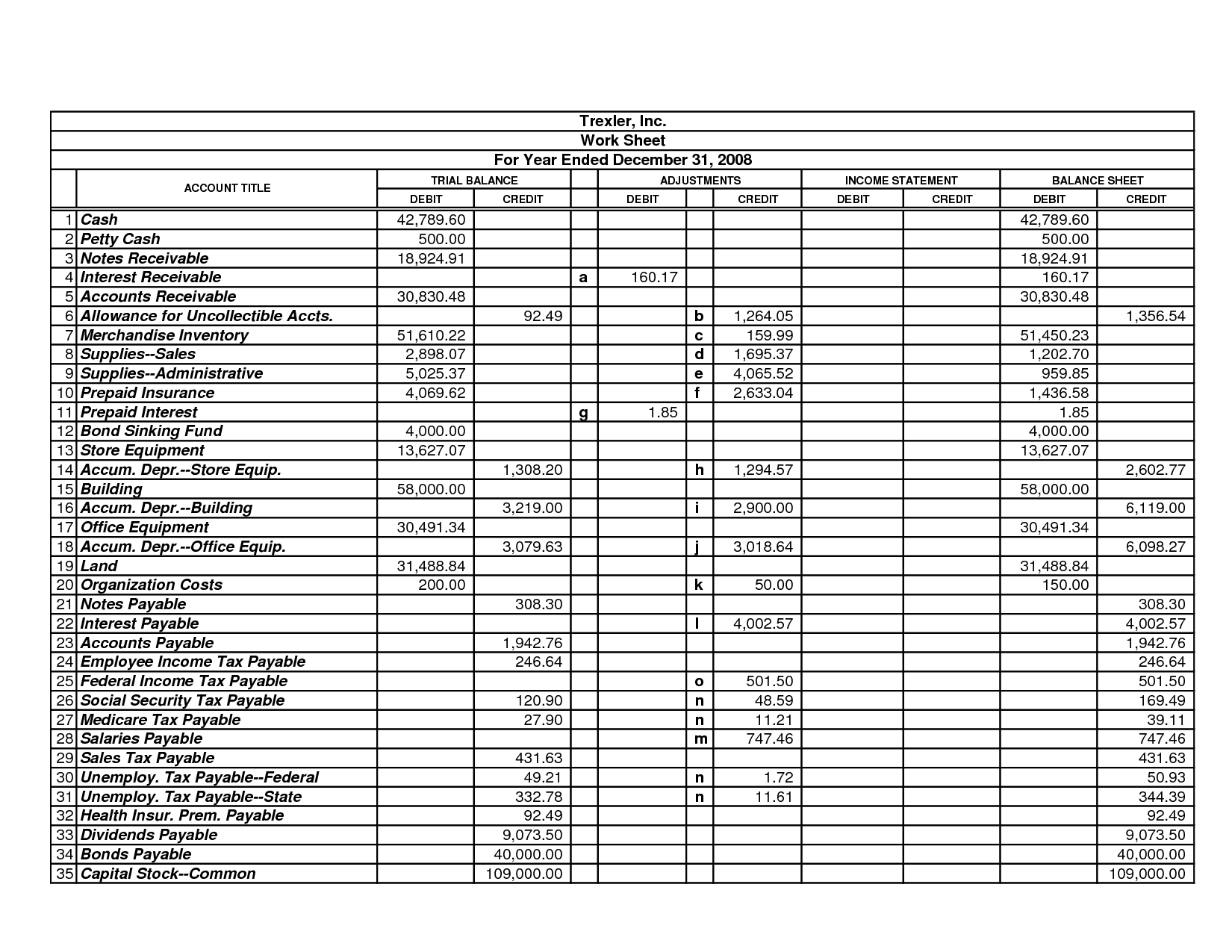

Based on the information covered in the lecture and the data used in your previous

assignments, use a worksheet (provided in my downloads section) and enter all

adjustments into your books. You have the option of backing up and entering this new

information into your lab 5 work or continue business after the close in lab 6 and perform

this adjustment at the end of the next month. (**NOTE: The second option is much easier

than the first in my opinion) In either case all documents from all labs should work together.

Once you have completed your worksheet, update your Journal and Ledger with the adjustments.

Remember --- all forms are provided in my downloads section

|

|

Email --

|

Attach all required documents to an email (ex: Inventory Spreadsheet, Adjustment Worksheet,

General Journal, General Ledger and Trial Balance)

Send these to me making sure to add "Lab 11" in the subject line and include your name

in the body of the email.

|

This is Part of the Final Project

|