You will also need to declare your fiscal accounting period. Your overall period will be a fiscal year (you decide when it starts) and your cycle period will be a fiscal month.

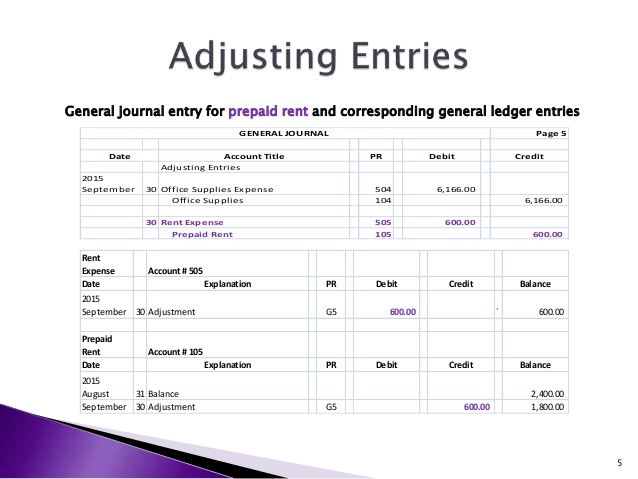

Based on the information covered in the lecture and the data used in your previous assignments, use a worksheet (provided in my downloads section) and enter all adjustments into your books.

All forms are available in the downloads section of my website

Send these to me making sure to add "Lab 5" in the subject line and include your name in the body of the email.

This time around the connection to the final is less direct. You will have adjusting entries in your Final Project / Final Exam, but there will be quite a bit more to adjust than what we have here. However, what we have here will be a part of your Final Project / Final Exam adjustments.